Additionally on this letter:

■ Singed by Luna’s collapse, crypto traders rethink bets

■ GIC in talks to speculate $75 million in Wow Pores and skin Science

■ Reliance Retail plans separate platform for third-party sellers

FirstCry pauses IPO plans as markets stay unstable

FirstCry will delay its planned $1-billion IPO by a few months, sources instructed us.

Delhivery impact: They stated the corporate’s cautious method follows the muted response to Delhivery’s IPO final week, amid broader headwinds in world markets.

Solely 24% of Delhivery’s IPO was subscribed on the second day of its issue, signalling an absence of pleasure from retail and high-net-worth traders, leaving firm insiders on tenterhooks till the IPO was totally subscribed on the ultimate day.

Particulars: The Pune-based e-tailer had finalised plans to file its draft IPO papers this month however is pulling again on the recommendation of its traders and bankers, sources stated.

FirstCry, which additionally runs offline shops, can be pondering of ‘recalibrating’ its concern dimension and the valuation it is going to look for the IPO, they added.

It was aiming for a valuation of near $7 billion for a difficulty dimension of $1 billion with a suggestion on the market (OFS) element of round $700 million, we reported final month.

Tough waters: Public markets have been uneven for months, led by adjustments in macroeconomic circumstances and the present Ukraine-Russia disaster, forcing even Life Insurance coverage Company of India (LIC) to postpone its gigantic public providing and lower its concern dimension. Delhivery, too, had delayed its IPO and lowered its dimension from Rs 7,460 crore to Rs 5,235 crore.

Final week, SoftBank – the most important investor in FirstCry – stated it will cut down new investments by up to 75% this yr after reporting file losses in its Imaginative and prescient Fund models. Chief govt Masayoshi Son stated public markets globally would take one other yr or two to get well.

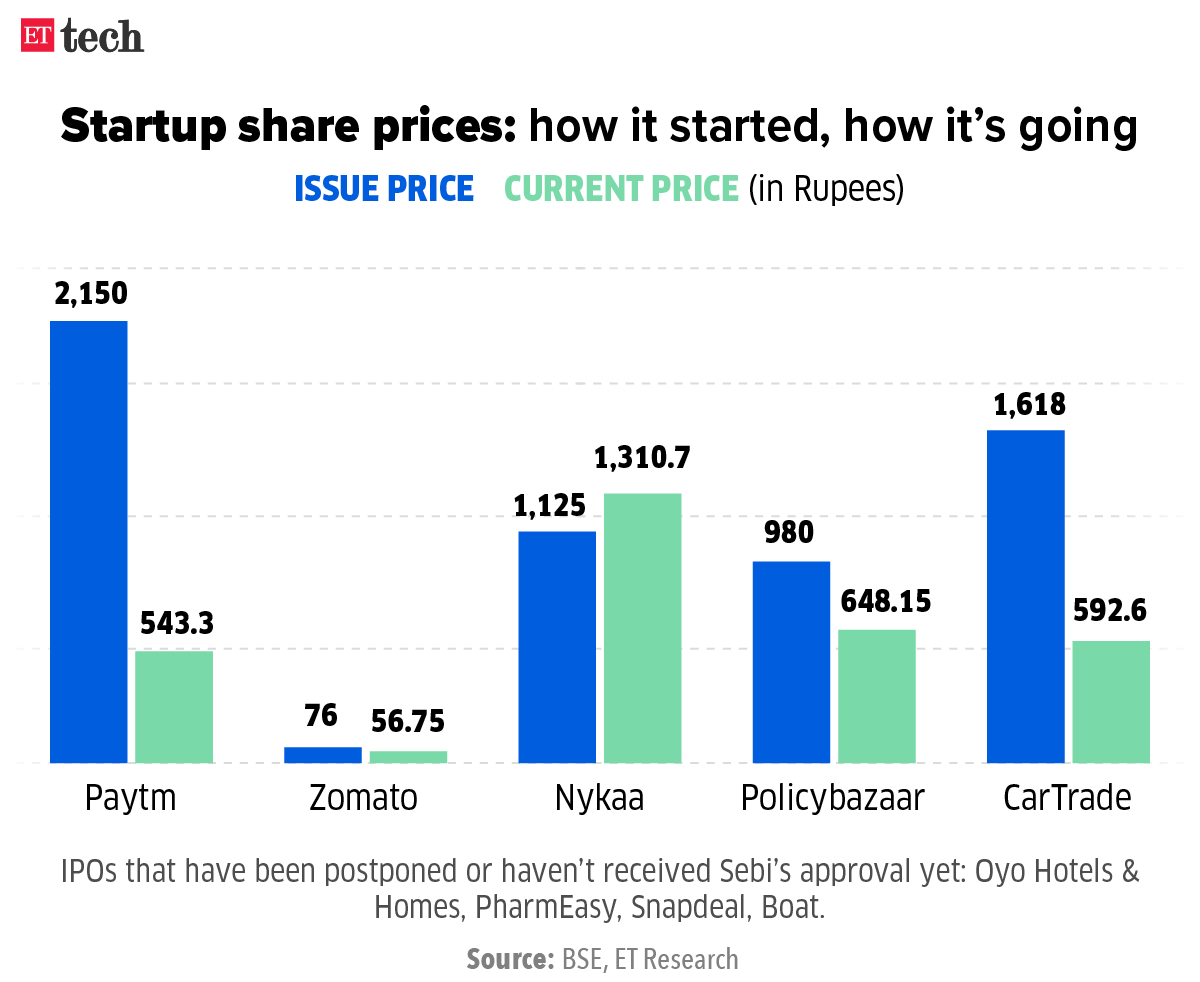

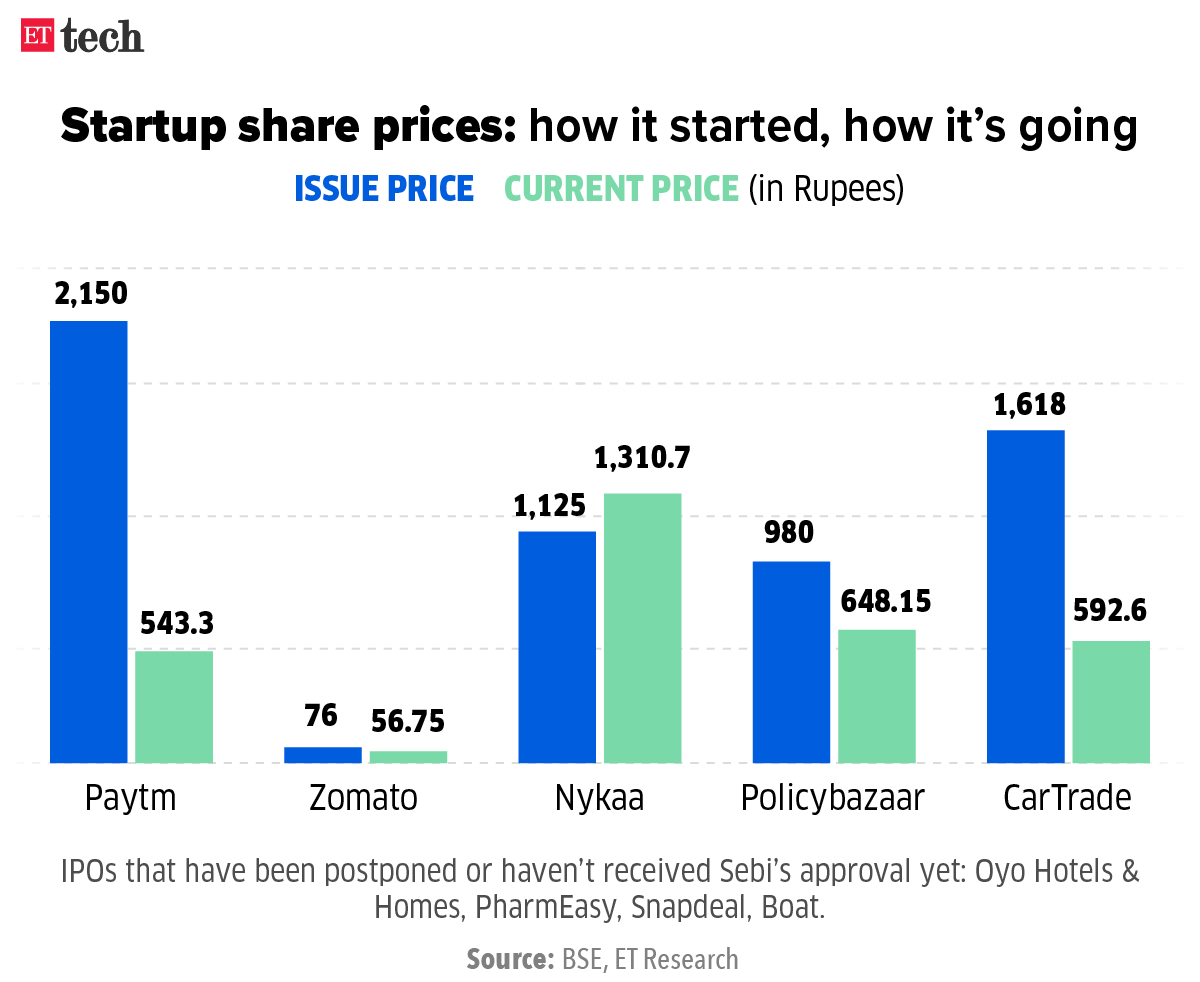

Massacre: Share costs of new-economy corporations that listed throughout final yr’s bull run – equivalent to Zomato, Paytm and Nykaa – are at the moment buying and selling effectively beneath their highs. Zomato’s shares dipped beneath their concern worth of Rs 76 in late April and have been at Rs 56.75 on Friday. Paytm’s shares have misplaced greater than 70% of their worth from the difficulty worth of Rs 2,150.

On maintain: PharmEasy, which has obtained regulatory clearance for its Rs 6,250 crore IPO, Snapdeal, Oyo and Boat are different new-age companies which can be going gradual on their IPO plans after having filed their draft papers.

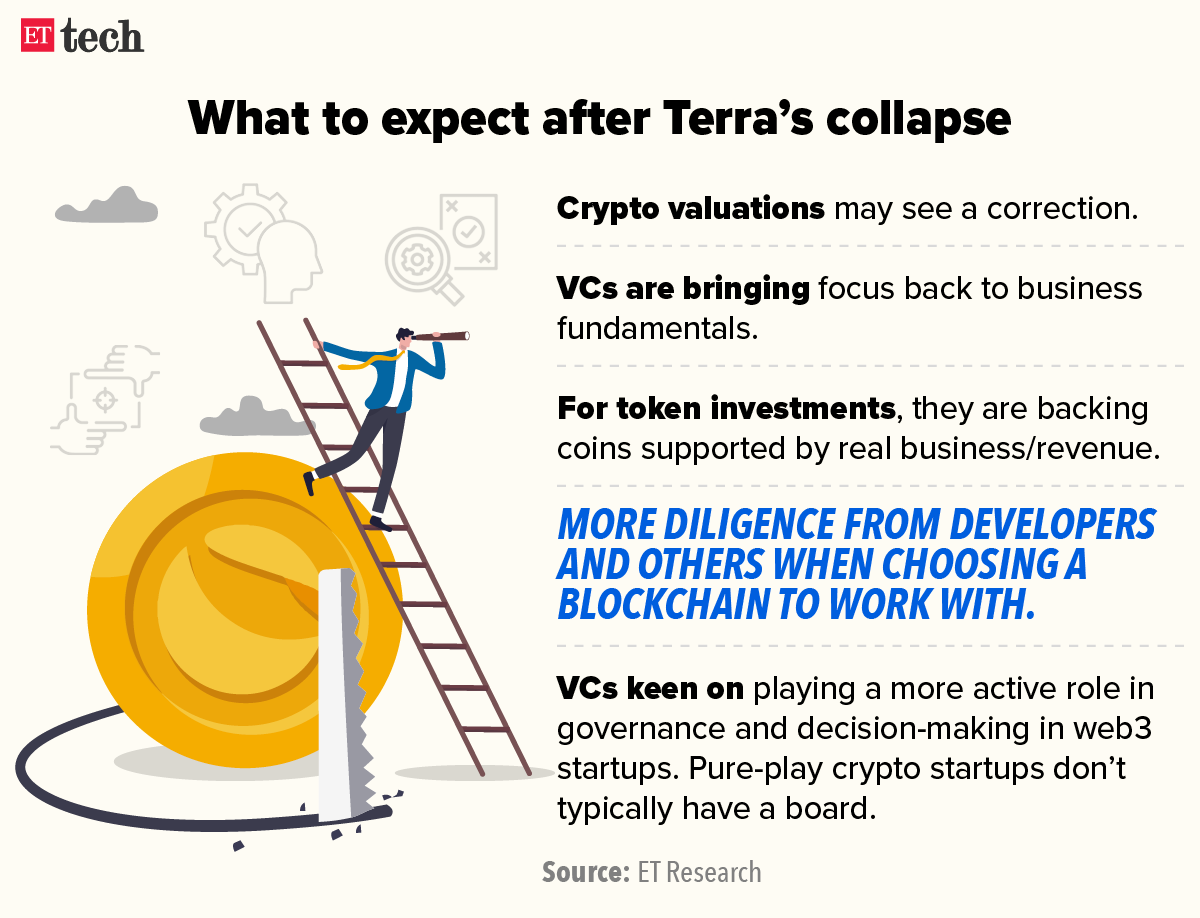

Singed by Luna’s collapse, crypto traders rethink their bets

Ashwin Nadar, a 25-year-old software program engineer based mostly in Mumbai, remains to be reeling from the sudden collapse of Luna, a well-liked cryptocurrency, final week.

“It was a disturbing occasion. I purchased Luna at $73 and acquired out at 24 cents,” he stated. “I had a small funding, however as somebody who believed in ‘good contract’ cryptos, it was painful to look at the occasion unfold.”

Crashlanding: Luna plummeted to $0.0002996 on Sunday after touching an all-time excessive of $119 over the previous 12 months, wiping out crores from Indian crypto traders’ portfolios.

Already reeling from India’s harsh new taxes on crypto, many are rethinking their investments and rejigging their portfolios as bears proceed to batter the market.

Dhruv Sharma, a 26-year-old Supreme Courtroom lawyer in New Delhi, stated his portfolio is within the crimson, regardless of having began investing in crypto 4 years in the past, as a result of he continued to purchase extra crypto over the previous yr when these digital belongings hit all-time highs.

Like Nadar, he’s shifting out of altcoins and shopping for Bitcoin and Ethereum at decrease costs to stabilise his portfolio.

The Luna crash has additionally scared away many new crypto traders, who aren’t used to this type of volatility.

Purchased the hype: Consultants stated the issue was that many Indian traders had little or no investments in comparatively steady cryptocurrencies equivalent to Bitcoin and Ethereum as their costs have been already excessive. As a substitute, they purchased altcoins (the title given to all cryptocurrencies apart from Bitcoin) with out understanding the dangers.

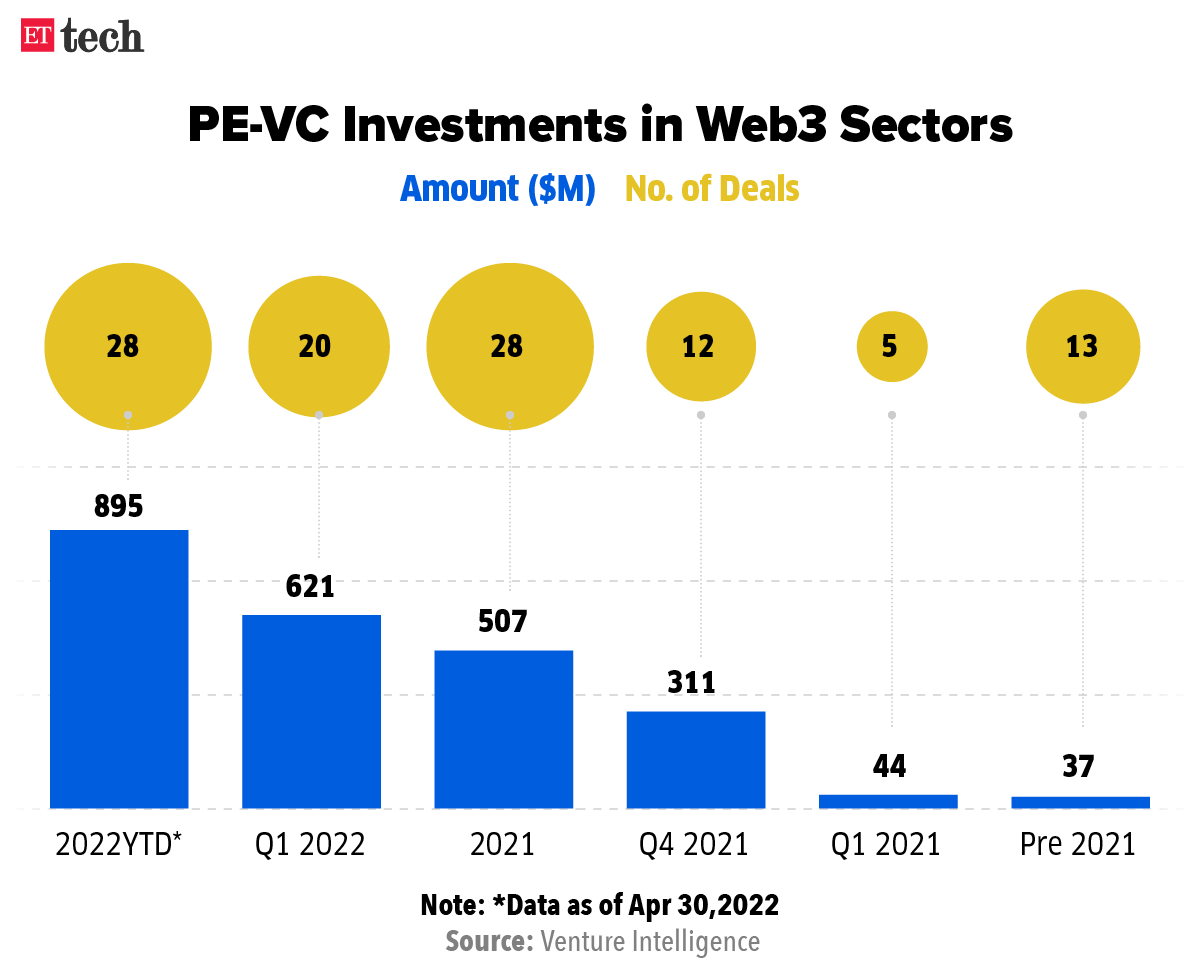

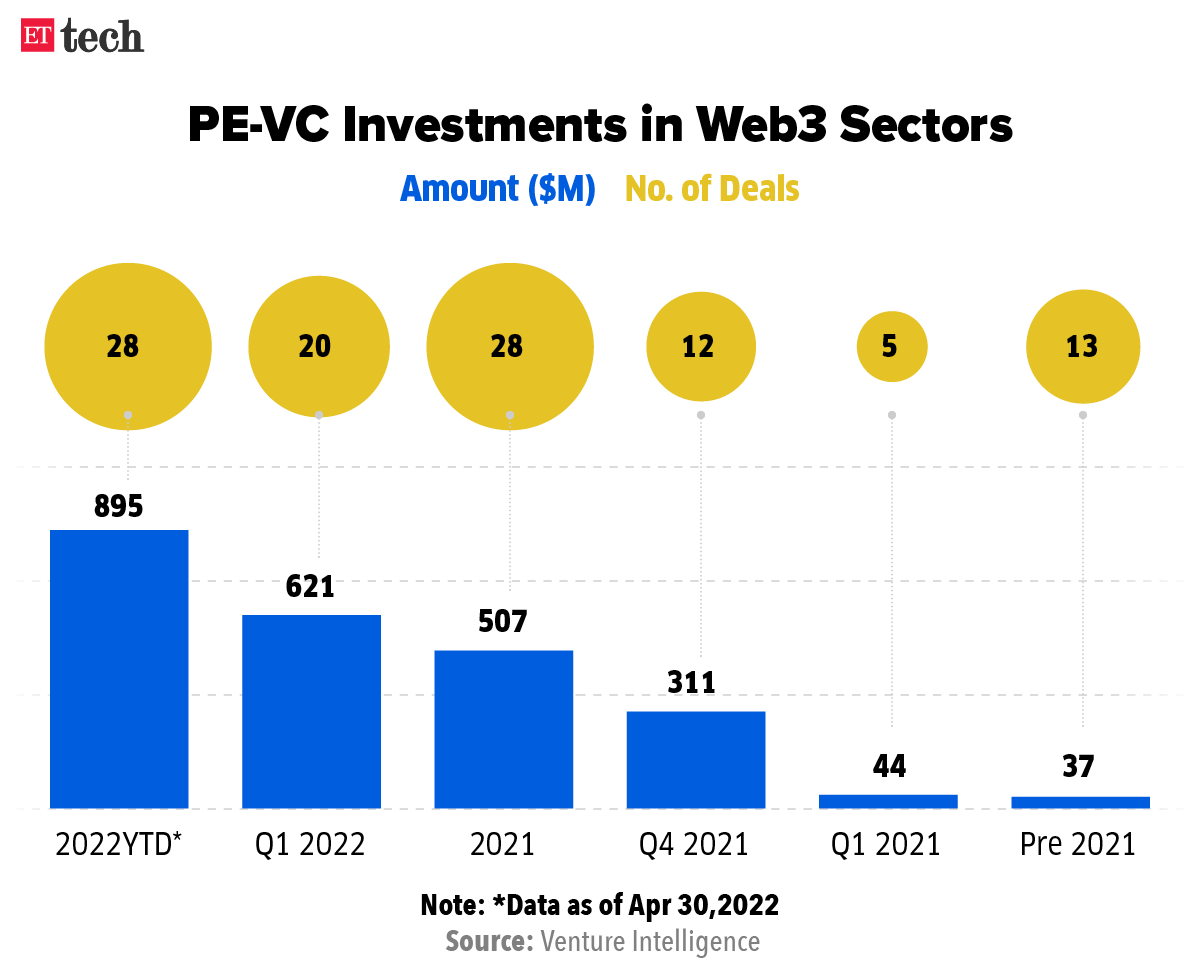

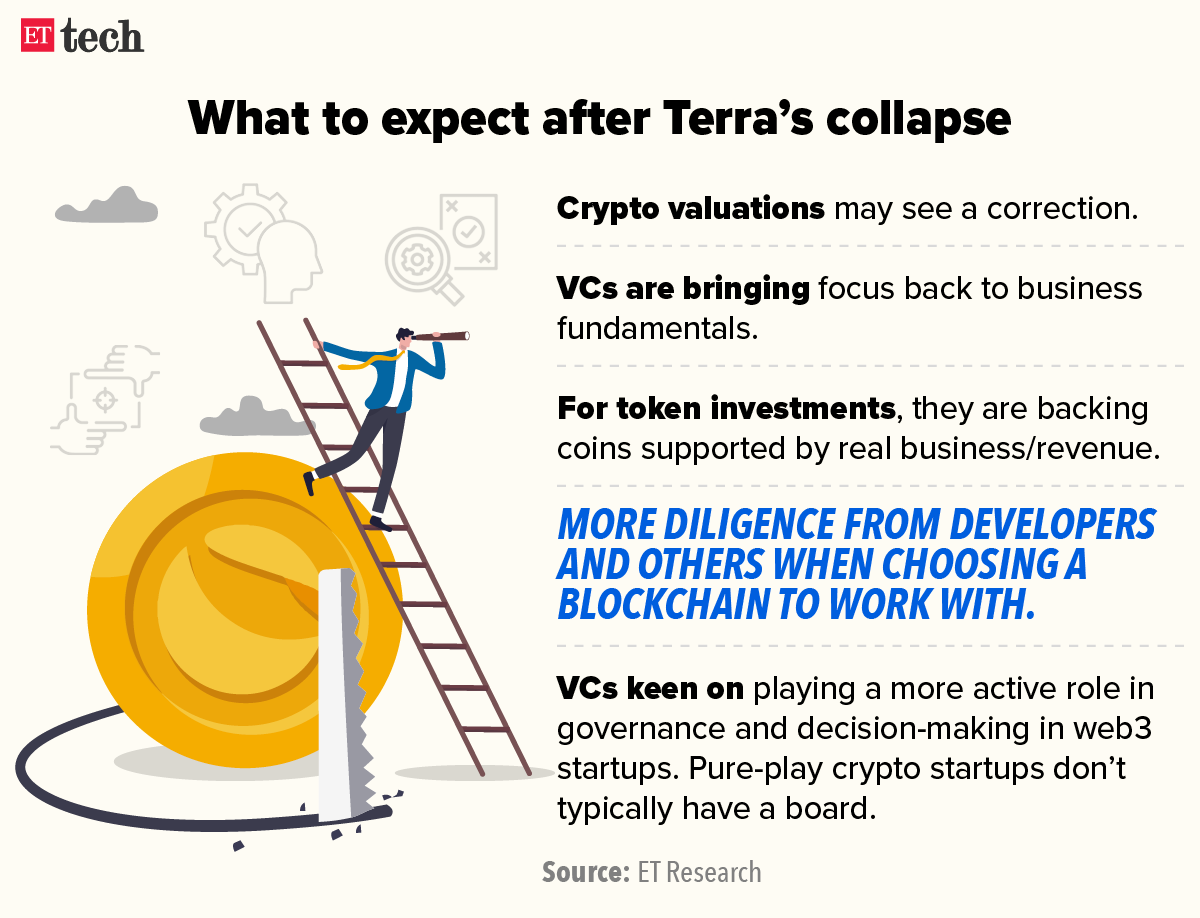

VC companies hit, too: Indian retail traders usually are not the one ones struggling after the collapse of Luna and UST, its related ‘stablecoin’ on the Terra blockchain. Indian venture capital firms that had exposure to the Terra ecosystem have also taken a hit.

Accel India had backed no less than two initiatives constructing for the Terra ecosystem, Stader Labs and Leap Pockets, regardless of the crimson flags across the blockchain and its founder.

And Sequoia Capital India, which has backed a few dozen web3 startups in India, together with Polygon, made about 70% of those investments in change for crypto tokens, which have misplaced important worth over the previous week or so.

GIC in talks to speculate $75 million in Wow Pores and skin Science

Singapore’s sovereign wealth fund GIC is in talks to pick up a significant minority stake in direct-to-consumer (D2C) magnificence and private care model Wow Pores and skin Science for $75 million, 4 sources instructed us.

The deal would give the ChrysCapital-backed firm a post-money valuation of $400-420 million.

The corporate’s present traders can even top-up capital to take care of their stakes, stated one of many folks. Final yr, ChrysCapital acquired about 35% stake in Wow for $50 million, valuing it at Rs 900 crore.

It has additionally evaluated some smaller acquisition targets to fill product and distribution gaps, the supply added.

Based in 2014 by brothers Manish and Karan Chowdhary, the corporate’s working income grew to Rs 100 crore within the monetary yr ending March 31, 2021, from Rs 6.5 crore in FY20, filings confirmed. It recorded a loss in FY21 of Rs 8.8 crore in comparison with a revenue of Rs 9 lakh in FY20.

Wow competes with clear magnificence and pure magnificence D2C manufacturers equivalent to Plum, EarthRhythm, Juicy Chemistry, Natural Harvest, mCaffeine, Beardo, Mamaearth and Bombay Shaving Firm.

TWEET OF THE DAY

Reliance Retail plans separate platform for third-party sellers

Reliance Industries has started roping in independent sellers on its ecommerce platform, JioMart. It plans to finally create a separate market the place it is going to home all third-party sellers, two trade executives conscious of the plans stated.

Reliance is seeking to be ready for the government’s proposed ecommerce policy, which is prone to prohibit market operators from having associated events or related enterprises as sellers on their platforms.

The Tatas and some others are reportedly against such a situation, however Reliance is alleged to be in favour of it and desires to assist impartial sellers by a separate platform, the executives stated.

The proposed platform, which is but to be named, could have the ‘Jio’ branding. JioMart will stay the ecommerce arm of Reliance Retail for all its personal manufacturers and codecs after the brand new market comes up.

Want ARR-based valuation amid hype round SaaS companies: report

The software-as-a-service (SaaS) panorama has seen a surge in unicorns, but some valuations have been inflated by ‘hype’ and firms will quickly have to return to enterprise fundamentals equivalent to creating nice merchandise and enhancing customer support, based on a report by enterprise capital agency Bessemer Enterprise Companions.

Annual recurring income (ARR) – a SaaS metric – is the appropriate yardstick to measure success on this area, the report stated, underscoring $100 million ARR as an inflection level in a SaaS firm’s journey.

“At $100 million ARR, [companies] have product-market match, scalable go-to-market technique, and a rising buyer base,” the report stated.

SaaS entrepreneurs agreed there was a have to redouble deal with fundamentals, however strongly disagreed that valuations have been “hyped”.

TCS introduces Tata manufacturers to the metaverse

Tata Consultancy Providers (TCS) is engaging with Tata group companies like Tanishq, Tata Motors and Croma to deploy metaverse solutions, a senior govt instructed us.

What’s taking place: Tata group’s jewelry arm Tanishq not too long ago launched its new assortment within the metaverse, the place prospects can attempt on bespoke items. The corporate can be engaged on an answer to launch a museum metaverse for the Tamil Nadu authorities, stated Ashok Maharaj, Head, TCS XR Lab.

Final month, Jaguar Land Rover, a subsidiary of Tata Motors, introduced the launch of its open innovation platform that may construct a mobility ecosystem incorporating the metaverse.

Different Tata manufacturers like Tata Tea have additionally been tapping the metaverse for product launches.

The corporate can be partnering with various Huge Tech corporations in facilitating each {hardware} and software program options within the metaverse and associated areas.

Different Prime Tales By Our Reporters

Paytm sees over five-fold development on loans: Paytm disbursed 15.2 million loans in fiscal yr 2022 (FY22), greater than five-fold development from FY21 when the variety of total loans disbursed on the platform stood at 2.6 million, based on knowledge launched by its guardian firm One97 Communications on Sunday.

Important to faucet the appropriate expertise, says Nasscom chairman: The IT trade’s prime precedence is to make India the digital hub of the world, stated Krishnan Ramanujam, the newly appointed chairman of IT trade physique Nasscom. Tapping India’s massive talent base effectively to support the current demand environment for the $220 billion Indian IT trade over the following decade can be key to this aim, Ramanujam instructed us in an interview.

Technocrats are guided by the motto ‘in science, we make investments’: An influential set of technocrats is actively investing in core areas of research and inserting long-term bets on prime scientific establishments searching for boundary-smashing breakthroughs.

How ‘giving’ was diversified past billions: In 2018 throughout Daan Utsav, the weekly pageant of giving held throughout India, a bunch of six volunteers began questioning why India didn’t have something just like the Giving Pledge, beneath which a number of billionaires world over had pledged to donate a certain portion of their wealth to charity. Prior to now few years, a number of head honchos from India Inc have pledged to donate no less than half their wealth in the direction of charity beneath Residing My Promise (LMP).

International Picks We Are Studying

■ Behind fake-account concern that Elon Musk cited in calling Twitter deal ‘on maintain’ (WSJ)

■ International tech’s changemakers (Rest of World)

■ Can we create an ethical metaverse? (The Guardian)

At present’s ETtech Morning Dispatch was curated by Zaheer Service provider in Mumbai and Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.