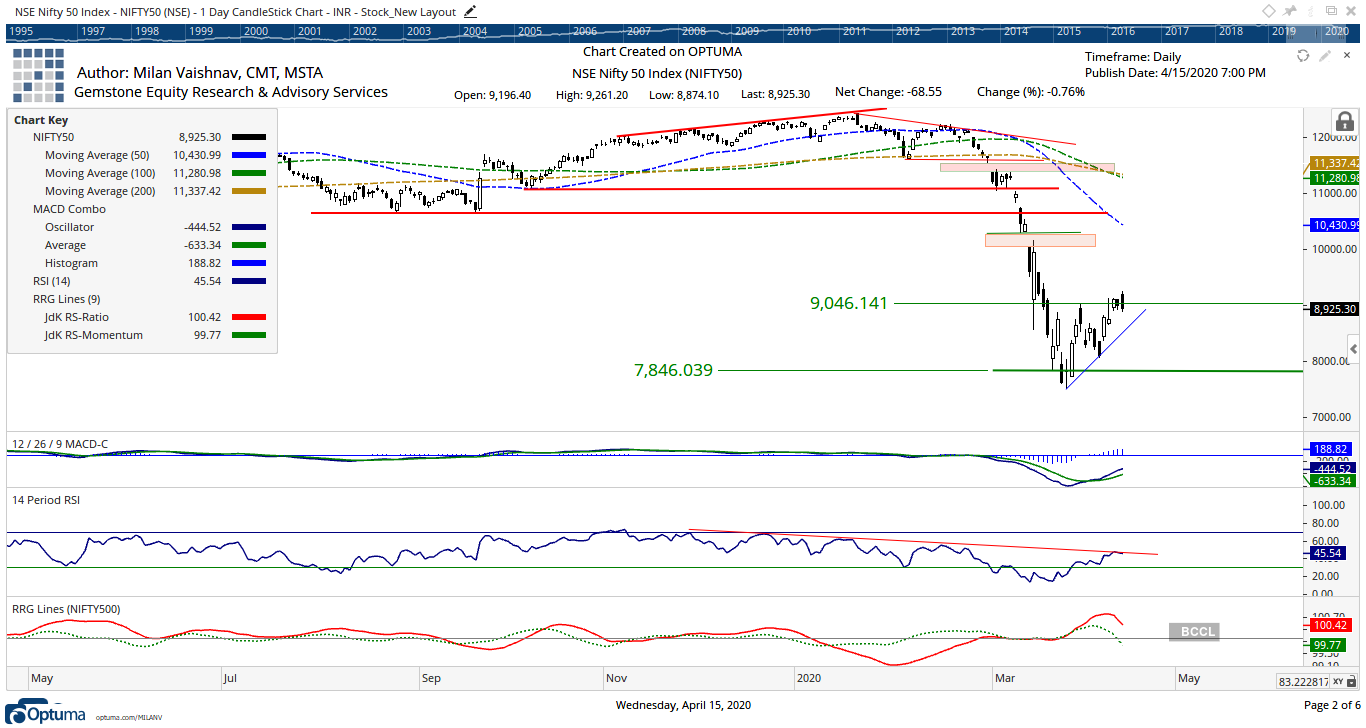

With Nifty failing to maintain its head above 9,050-9,100, this zone has bolstered itself as a robust resistance space. The index transferring previous this zone will proceed to stay crucially vital if the market has to see any form of upmove. Until this occurs, the index can be susceptible at greater ranges.

Thursday’s session is predicted to see a smooth begin, with 9,000 and 9,070 ranges appearing because the resistance. Support might are available in at 8,830 and eight,775.

The Relative Strength Index (RSI) on the day by day chart was at 45.54 and stayed impartial, displaying no any divergence in opposition to the worth. The indicator is seen resisting a development line that joined its decrease tops shaped over the previous couple of days.

The day by day MACD was bullish and traded above its sign line. An engulfing bearish sample was shaped on the charts. The emergence of this sample close to 9,050-9,100 reinforces the credibility of this space as a robust resistance zone.

With Nifty failing to maneuver previous the 9050-9100 zone, the index will proceed to stay susceptible at greater ranges. The weekly choices expiry will even dominate the commerce as 9,000 has the utmost focus of Call open curiosity, which might act as a resistance until a tactical shift happens. We would advise merchants to proceed to keep away from recent lengthy positions until the index strikes previous the vital resistance ranges. A cautious view is suggested for the day.

(Milan Vaishnav, CMT, MSTA, is a Consulting Technical Analyst and founding father of Gemstone Equity Research & Advisory Services, Vadodara. He might be reached at milan.vaishnav@equityresearch.asia)