Additionally on this letter:

- Tech IPOs want higher pricing disclosures, says Sebi chief

- Swiggy in talks to spend money on bike-taxi startup Rapido

- Epiq Capital makes first shut of its second fund

Amazon sues ED, asks courtroom to quash probe into Future Group deal

Amazon moved the Delhi Excessive Courtroom on Wednesday, seeking relief from an ongoing investigation by the Enforcement Directorate (ED) into its 2019 funding in a Future Group firm.

Allegations: Accused the company of overreach, Amazon requested the courtroom to halt the probe and cease it from issuing summons. The ED had begun the probe final month to seek out out if Amazon had violated India’s overseas change guidelines whereas investing into Future Coupons Pvt Ltd (FCPL) in 2019.

Amazon additionally alleged that the ED has requested it for accounts of privileged authorized opinion given to it by attorneys and regulation companies in India. It stated it additionally requested it to offer an inventory of former staff in its authorized staff, and accounts of financial institution particulars and authorized bills it has incurred in India prior to now 10 years.

Accusing the ED of conducting a “fishing and roving inquiry”, Amazon stated such requests had been past the company’s powers.

An enormous mess: The 2019 funding has triggered greater than two dozen authorized circumstances between Amazon and Future Group within the Delhi Excessive Courtroom, the Supreme Courtroom and in numerous tribunals, together with the Nationwide Firm Legislation Tribunal (NCLT) and the Singapore Worldwide Arbitration Centre.

The dispute has additionally placed on maintain for greater than a 12 months a deal wherein Future Group agreed to promote its property to Reliance Retail for Rs 25,000 crore. Amazon stated the phrases of its 2019 funding in FCPL – which owns 10% of the listed Future Retail Ltd (FRL) — bar FRL from promoting any of its property to a number of firms together with Reliance.

Final week, the Competitors Fee of India (CCI) had suspended its 2019 approval for Amazon’s investment into FCPL and fined the corporate Rs 200 crore.

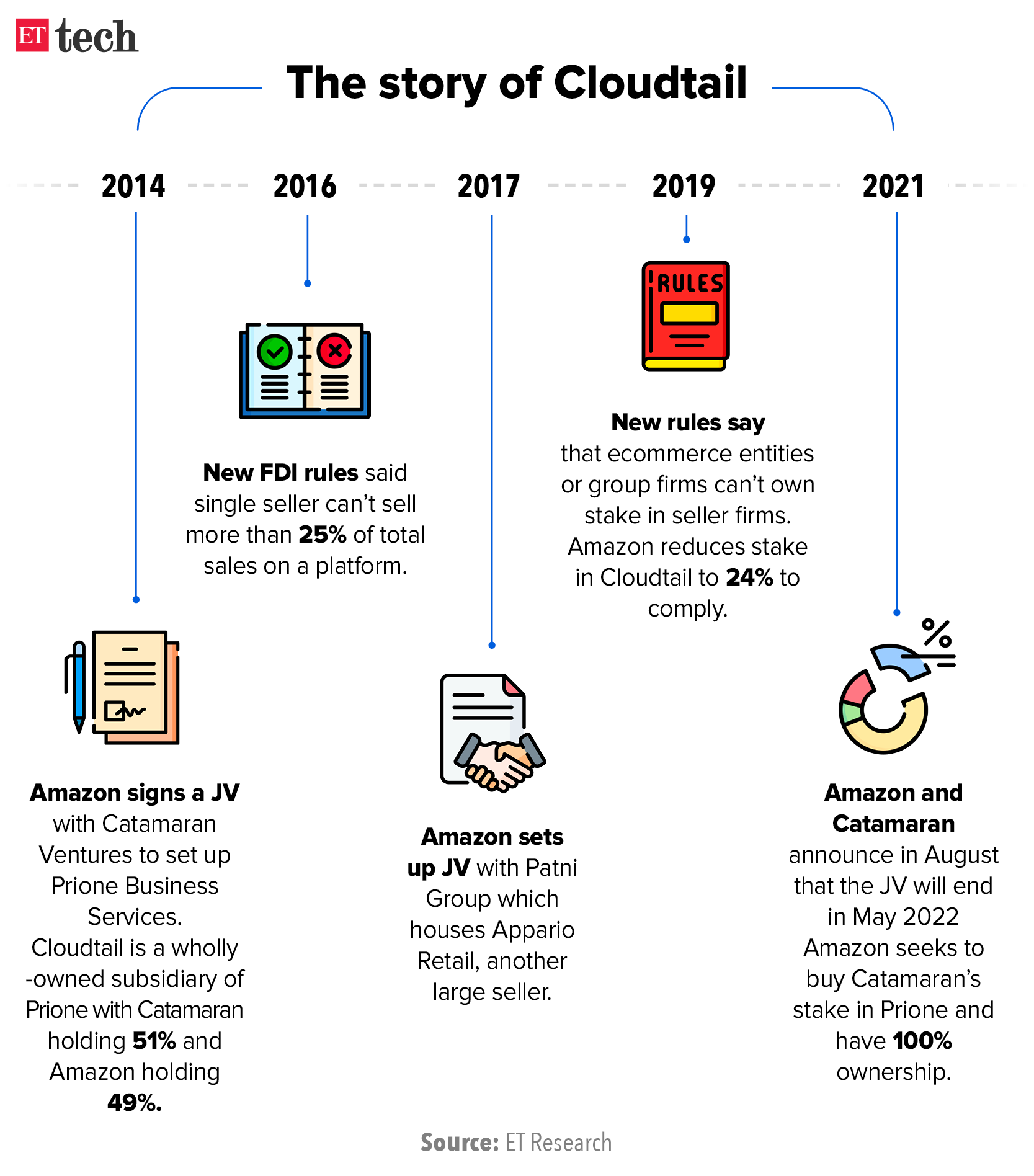

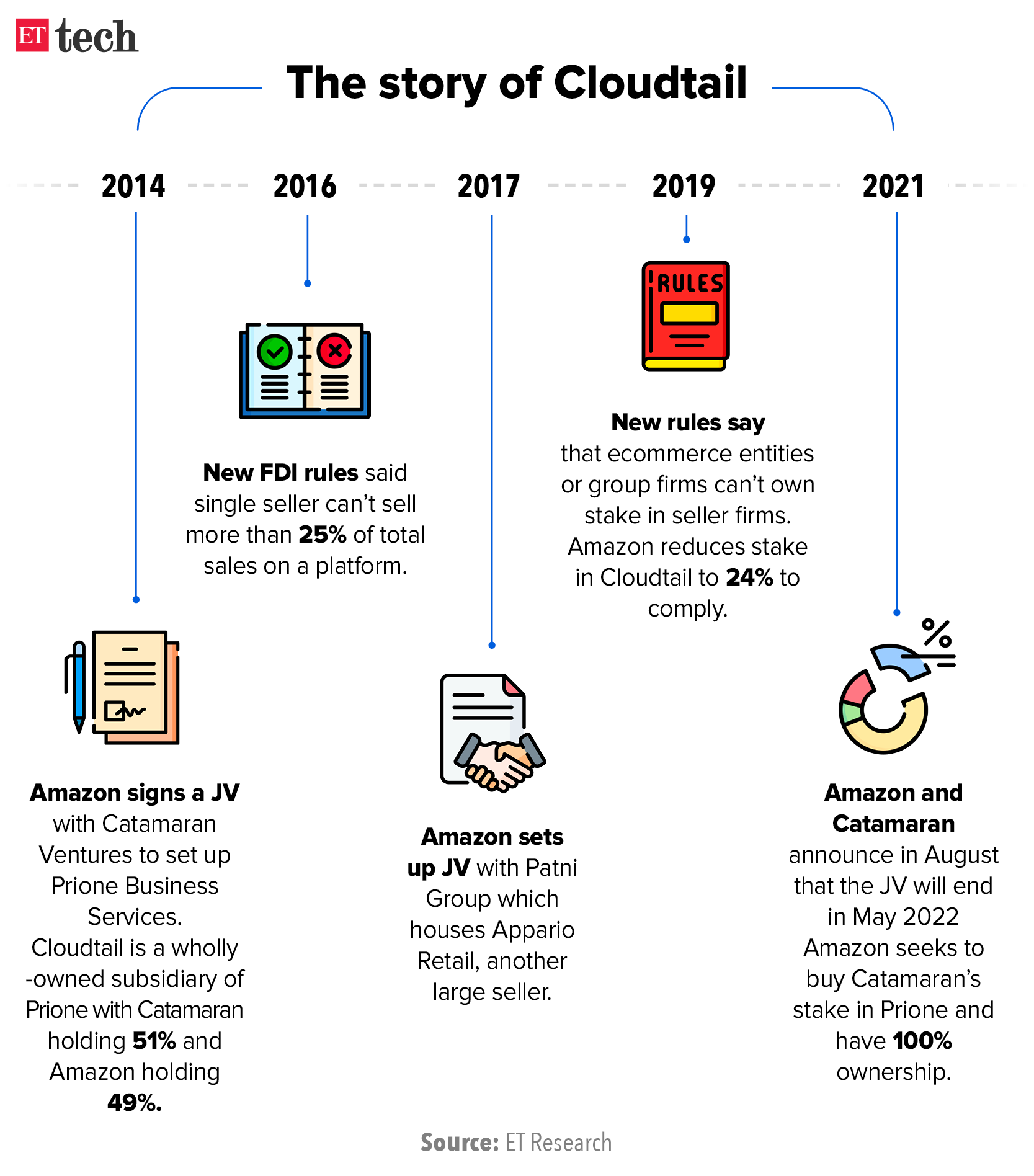

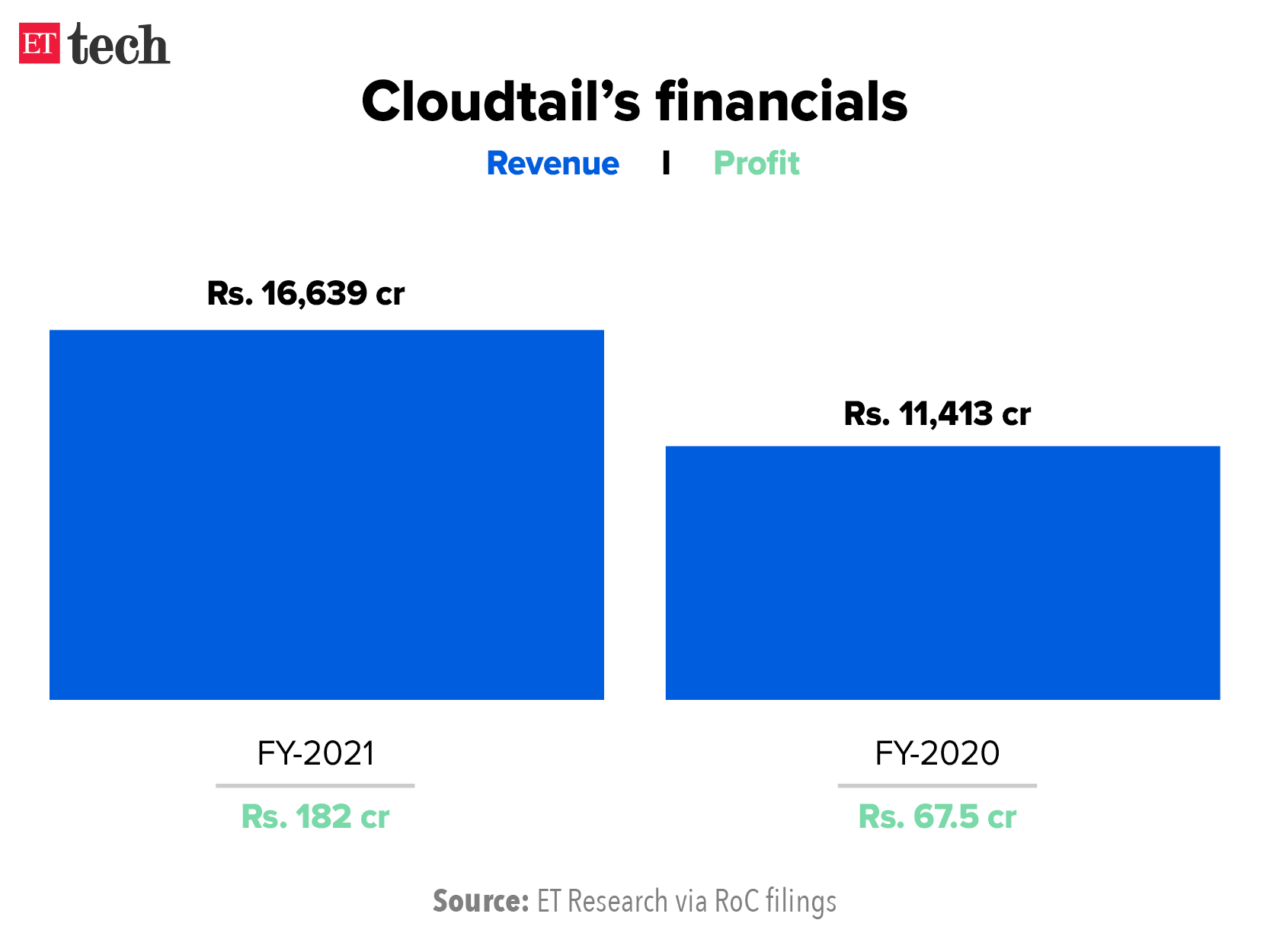

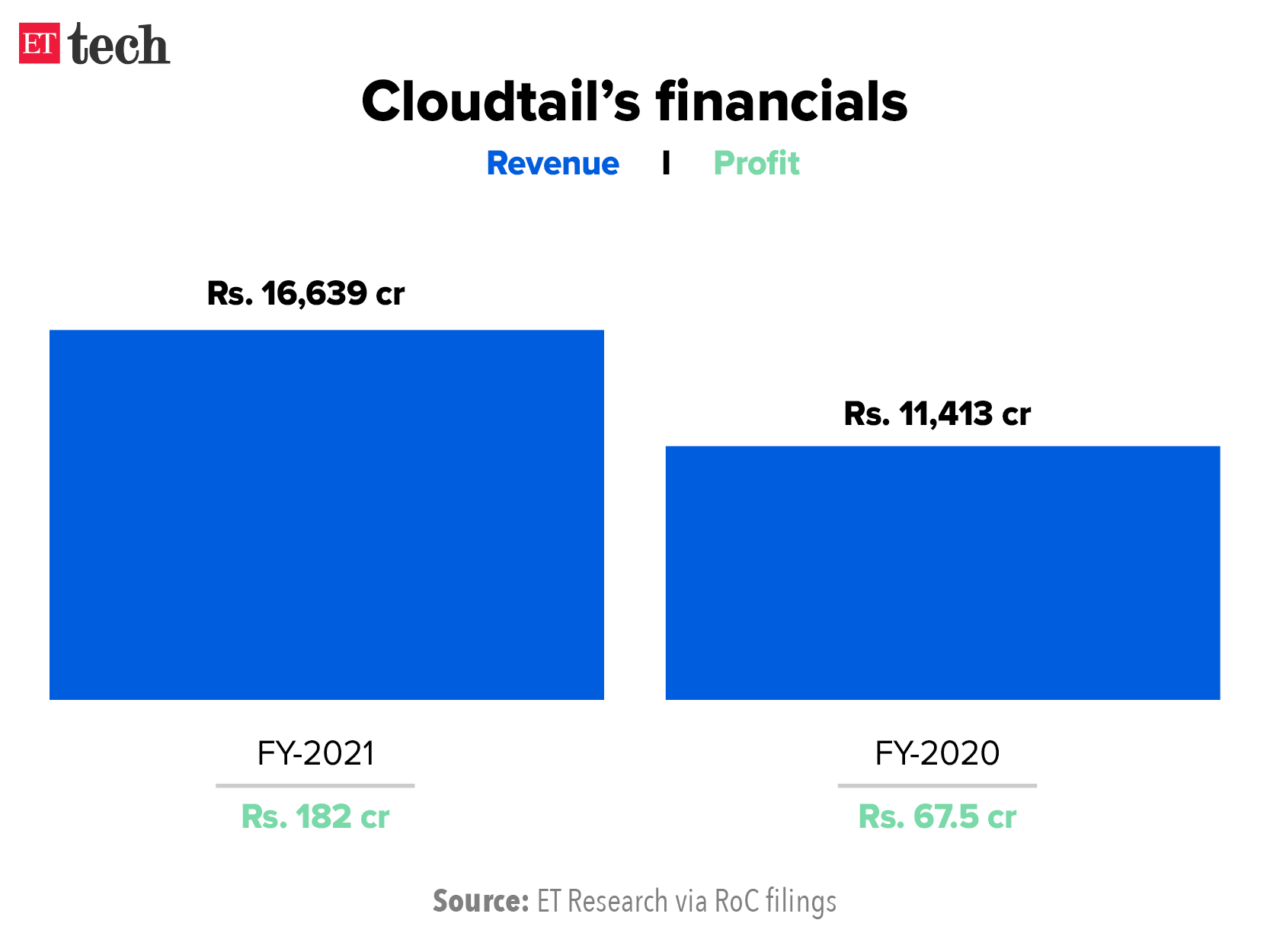

Amazon seeks Cloudtail takeover: In the meantime, Amazon and Catamaran Ventures, the funding workplace of Infosys cofounder NR Narayana Murthy, stated in a joint assertion on Monday that the ecommerce major will acquire Catamaran’ stake in Prione, which houses Cloudtail, one of many largest sellers on Amazon In India.

The announcement comes 4 months after Amazon and Catamaran stated they might discontinue their partnership in Prione in May 2022.

Sure, however: The deal is after all topic to regulatory approval. A supply advised us that Amazon has already made a submitting with the Competitors Fee of India (CCI).

Enterprise goes on: The 2 entities stated within the assertion that the companies of the three way partnership would proceed beneath the management of the present administration. “Amazon will purchase Catamaran’s shareholding in Prione in compliance with relevant legal guidelines together with all property and liabilities…On receipt of regulatory approvals, the board of Prione and Cloudtail will take steps to finish the transaction in compliance with relevant legal guidelines,” they stated.

Tech IPOs want higher pricing disclosures, says Sebi chief

Sebi chairman Ajay Tyagi stated on Wednesday that appropriate pricing was crucial for public issues, particularly these of new-age know-how firms, and that it was as much as service provider bankers to comply with the foundations in letter and spirit. He added that the regulator would tweak the foundations for new-age tech companies.

Context: His remarks come after some firms, most notably Paytm, noticed their share price fall drastically from the IPO value when itemizing.

What he stated: Tyagi urged service provider bankers to carry wider consultations for a correct steadiness between the issuers’ aspirations and traders’ pursuits. “Evidently, Sebi is not going to shrink back from taking required motion if it finds any middleman not adhering to its mandate,” he added.

He additionally listed the obligations of service provider bankers, akin to defending the pursuits of traders, conducting enterprise with integrity, and making true and well timed disclosures to traders so they’re conscious of the dangers when investing determination.

Yr of the IPO: The present fiscal has been a bumper 12 months for IPOs in India. There have been 76 preliminary share gross sales as of November, elevating a mixed Rs 90,000 crore. The variety of retail traders taking part in IPOs has additionally skyrocketed. Retail traders have filed 5.43 crore IPO functions up to now this fiscal in opposition to 3.8 crore in all of FY21.

Extra tightening: Tyagi’s feedback come simply over a month after Sebi proposed to restrict the cash raised from IPOs that startups can use for mergers and acquisitions (M&As), until takeover targets are explicitly recognized beforehand.

“It’s proposed to prescribe a mixed restrict of as much as 35% of the recent problem measurement for deployment on such objects of inorganic progress initiatives and GCP (common company objective), the place the meant acquisition/strategic funding is unidentified within the objects of the provide,” Sebi stated.

Tweet of the day

Swiggy in talks to spend money on bike-taxi startup Rapido

Swiggy is in the final stages of talks to invest in Rapido, a bike-taxi startup primarily based in Bengaluru, two sources advised us. The potential funding from the meals supply agency is a component of a bigger $150-200 million funding spherical that Rapido is in talks to lift.

Significance: If the deal goes by, it is going to be Swiggy’s first wager within the mobility sector. It’s going to improve the corporate’s last-mile supply capabilities and enhance its fast commerce ambitions.

Zomato talks fell by: Individuals conscious of the event advised us that Rapido was additionally in talks with Zomato, however these conversations fell by just lately. Zomato has been on an funding spree since going public, having backed startups akin to Blinkit (formerly Grofers), Shiprocket and Magicpin.

Doable synergies: “Essentially bike taxis and meals supply are extremely complementary,” stated Kunal Khatter, who heads a VC agency Advantedge and is an investor in Rapido. “As a lot as 80% of deliveries occur throughout lunch and time for supper. There’s idle capability throughout mornings and evenings. Bike-taxis are the alternative (busy throughout rush hours and comparatively free throughout mealtimes).”

For now, although, Swiggy’s funding is a purely monetary one, a number of sources advised us.

Swiggy has been aggressively foraying into new classes in current months. We now have been reporting on the meteoric rise of India’s so-called fast commerce companies, led by the likes of Swiggy’s Instamart, Zepto and Blinkit, which promised deliveries in 10-20 minutes.

Swiggy’s warfare chest: We had reported on September 28 that Swiggy was in talks to bring on board US asset manager Invesco in what was prone to be a pre-IPO spherical, making the corporate a decacorn (value greater than $10 billion). Srisharsha Majety, Swiggy’s cofounder and CEO, advised us just lately that $700 million of the new funds would be used to grow for Instamart.

Epiq Capital makes first shut of its second fund

Mumbai-based funding fund Epiq Capital has made the first close of $100 million for its second fund, with restricted companions (LPs) akin to Bollywood star Aamir Khan, cricketer Virat Kohli and entrepreneurs akin to Curefit founder Mukesh Bansal becoming a member of in as sponsors, sources advised us.

The fund has additionally elevated its complete measurement to $200 million from the $150 million that it was seeking to mop up initially, which ET reported on October 5.

The choice to extend the fund measurement comes as home sponsors (LPs) are more and more eyeing the thriving know-how startup area in a document 12 months of fundraising and IPOs for the sector.

Quote: “The fund made a primary shut of $100 million earlier within the month and is on observe to lift the total $200 million by the following quarter…,” stated an individual near the matter.

By means of its first fund of $100 million, launched 5 years in the past, Epiq invested in firms akin to eyewear e-tailer Lenskart, information aggregation platform Dailyhunt, and well being and health startup Curefit, amongst others.

From its second fund, it has participated in financing rounds of portfolio companies akin to Park+, an app for automobile customers, edtech startup Teachmint, and Pristyn Care, a health-tech firm, all of which have raised capital just lately.

Karnataka Excessive Courtroom reserves orders in on-line gaming case

The Karnataka Excessive Courtroom on Wednesday reserved orders after concluding hearings on petitions difficult the authorized validity of the state’s new regulation banning on-line video games of likelihood.

Senior advocate Mukul Rohatgi and others appeared for the petitioners, whereas Advocate Basic Prabhulinga Navadgi appeared for the state authorities.

Navadgi stated that Karnataka’s laws banning on-line gaming of likelihood, which treats these video games a menace, is the one considered one of its variety within the nation and couldn’t be in contrast with comparable laws in different states. Due to this fact, they can not draw references from judgements of different excessive courts on this case, he stated.

On October 4, the Karnataka authorities notified the law banning on-line “video games of likelihood”. Later that month the Annapoorneshwari Nagar Police in Bengaluru registered an FIR in opposition to fantasy gaming platform Dream 11 primarily based on a grievance from a metropolis resident who stated the corporate was violating the brand new state regulation. After the 2 founders filed a petition, the courtroom directed the police to not take coercive motion in opposition to them, together with arrest. This safety remains to be in drive.

H-1B visa approvals surge to 97% in fiscal 2021

The H-1B visa approval rate for fiscal 2021 was the highest in a decade. Owing to Covid-19 restrictions, the US immigration company needed to conduct a second visa lottery to satisfy its quota of 85,000 visas for the 12 months.

Particulars: The approval charge for H-1B visas in fiscal 2021 — from October 2020 to September this 12 months — was 97.3%, in line with knowledge launched by the US Citizenship and Immigration Companies (USCIS). The company acquired 398,267 petitions for preliminary and persevering with employment, or renewals, in the course of the interval.

Why now? Immigration watchers attributed this to the excessive demand for tech expertise within the US, as demand for digital transformation swept throughout sectors.

The excessive approval charge additionally displays a shift within the method of the US administration in the direction of immigration beneath President Joe Biden.

Quote: “Biden’s honest and liberal method in the direction of immigration is not like the Trump administration, which was extremely restrictive in granting immigration advantages to immigrants. Underneath the prior administration, USCIS officers had been directed to take very conservative views in approving H-1B functions. There have been a number of cases beforehand whereby real and bona fide functions had been denied in H-1B issues,” stated Naresh Gehi, founding father of Gehi & Associates, a US-based immigration regulation agency.

Different High Tales By Our Reporters

Salesforce launches startup programme in India: Buyer relationship administration agency Salesforce said that it has launched the Salesforce Startup Programme in India with a purpose to work with startups and assist them scale their ventures.

AngelList proclaims launch of roll up automobiles for Indian startup founders: AngelList, a platform that connects angel traders with startups, stated on Wednesday in a weblog submit on Medium that it has launched roll up vehicles (RUVs) for India.

Introduction Worldwide acquires Encora Digital from Warburg Pincus: Introduction Worldwide, the main world non-public fairness agency, has acquired a majority stake in Encora, a worldwide digital engineering companies firm specialising in software program product growth companies, in line with a press assertion.

International Picks We Are Studying